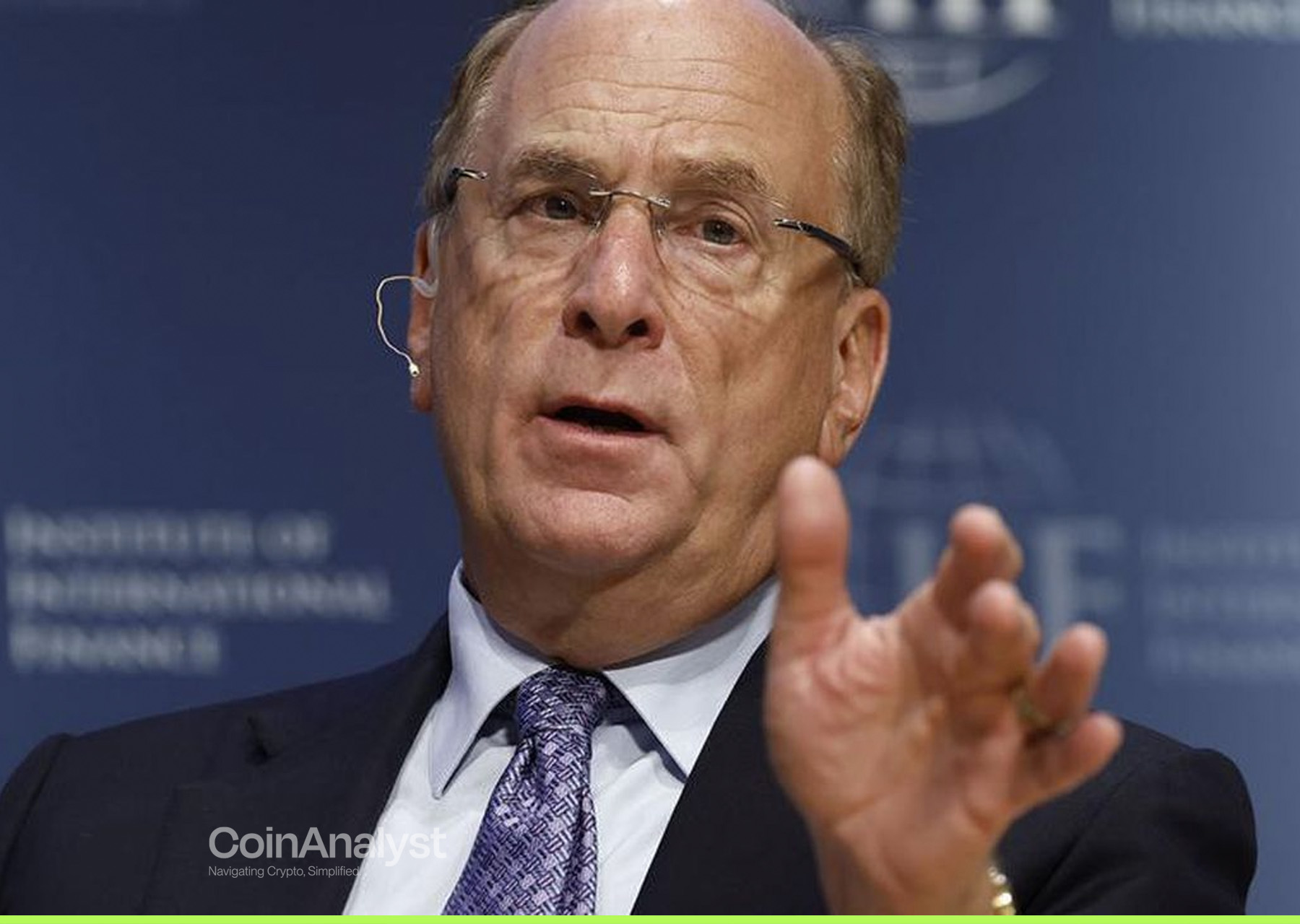

BlackRock, the world’s largest asset manager with over $9 trillion in assets under management, is closely watched for its insights into financial trends. In a recent interview with CNBC on January 11, 2024, CEO Larry Fink shared his thoughts on Ethereum ETFs and the broader cryptocurrency landscape. His perspectives offer a glimpse into the future of these emerging technologies and BlackRock’s approach to them.

Understanding Ethereum ETFs: A View from BlackRock’s CEO

What Are Ethereum ETFs?

Ethereum ETFs are exchange-traded funds that track the price of Ethereum, the second-largest cryptocurrency by market capitalization. They provide investors with exposure to Ethereum without the need to directly own the cryptocurrency, offering a simpler and safer alternative to purchasing and storing Ethereum on crypto exchanges or digital wallets.

Larry Fink’s Take on Ethereum ETFs

Larry Fink sees value in Ethereum ETFs for diversifying and adding liquidity to investor portfolios. He emphasizes Ethereum’s role as an innovative crypto platform enabling decentralized applications and smart contracts. These autonomous programs, he notes, can facilitate various operations in finance, logistics, law, and social settings, reducing intermediary involvement and fraud risk.

However, Fink points out that Ethereum ETFs are not yet available in the United States due to regulatory hurdles and market volatility. “While BlackRock has not launched an Ethereum-related product, we are closely monitoring the sector’s developments,” he adds.

Fink remains hopeful that U.S. authorities will soon green-light Ethereum ETFs, as has been done in countries like Canada and Germany.

Larry Fink on Cryptocurrency: Opportunities and Challenges

Crypto as a Financial Game-Changer

Fink compares the revolutionary impact of cryptocurrencies to that of the internet on communication and information. He believes that cryptocurrencies have the potential to alter how people exchange value and store wealth.

Challenges Facing Cryptocurrencies

Despite his optimism, Fink acknowledges significant challenges in the crypto space, including regulation, security, scalability, and mainstream acceptance. He warns of risks associated with volatility, speculation, and criminal activities like hacking, scams, and money laundering, which can tarnish crypto’s reputation.

Conclusion: Caution and Information Key in Crypto Investment

In concluding his interview, the CEO of BlackRock reminds that cryptocurrencies are still in an early development stage. He advises potential investors to exercise caution and stay well-informed.